If you think lawn care is just "mowing and blowing," you're missing out on one of the most explosive service industries in the United States. In 2026, the U.S. lawn care and landscaping market has officially crossed the $300 billion mark, driven by a perfect storm of suburban migration, aging homeowners, and the rapid adoption of autonomous mowing technology.

But the "green" isn't distributed equally. Whether you are a solo operator or managing a fleet, your earning potential depends heavily on your state's growing season, labor laws, and "route density."

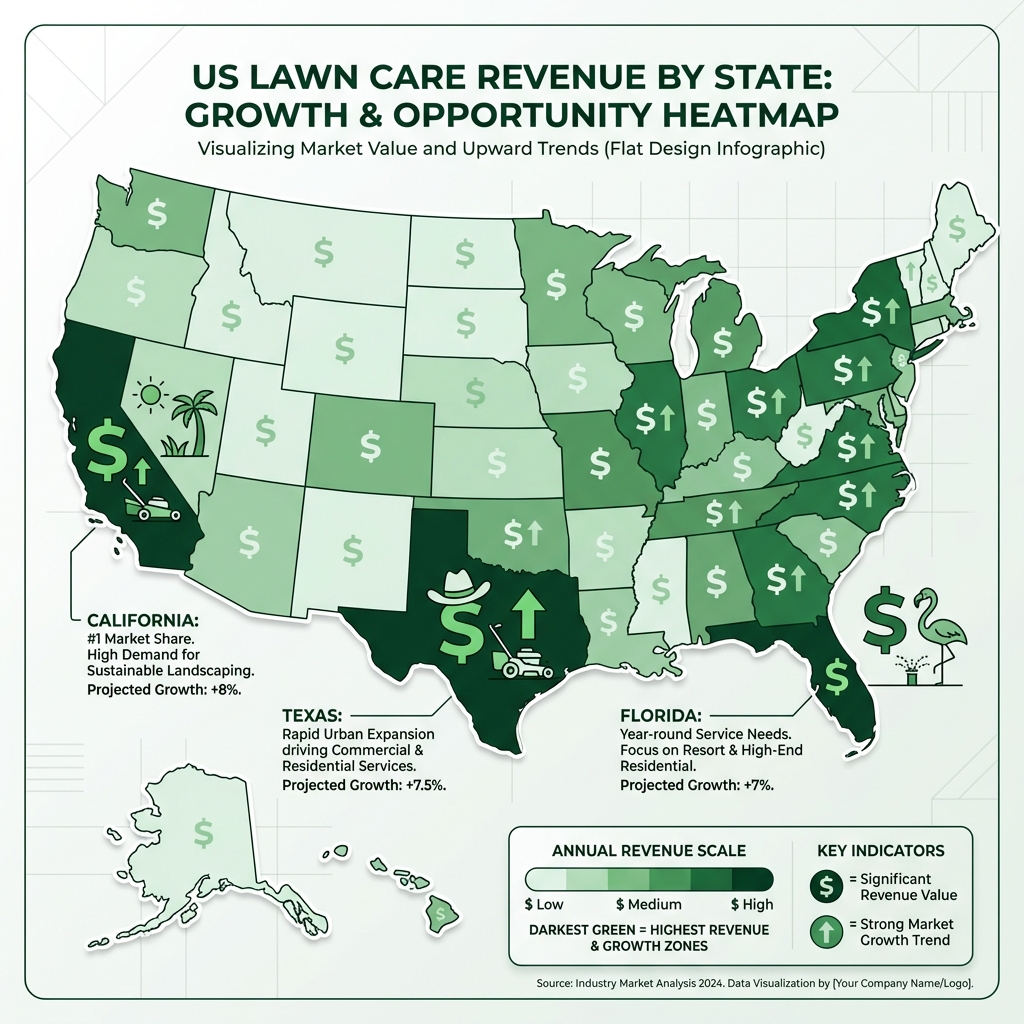

Here is the state-by-state breakdown of the lawn care industry in 2026.

1. The 2026 Market Snapshot

The industry has seen a 5.2% CAGR over the last few years, with a major shift toward high-margin recurring contracts rather than one-off cuts.

Key Performance Indicators (KPIs):

- National Average Owner Salary: $127,973 (Top 10% clear $290,000+).

- Average Revenue per Customer: $14,682 (for full-service maintenance).

- Average Net Profit Margin: 10% to 15% (Optimized routes hitting 20–25%).

- Average Mow Price (1/4 Acre): $55 – $85.

2. Revenue Powerhouses: Top States for Demand

In 2026, demand is no longer just about where the grass grows fastest; it's about where the population is moving. Texas, Florida, and California remain the "Big Three," but Colorado and Illinois have emerged as the states with the highest concentration of registered businesses.

| State | Estimated Total State Revenue (Contractor Total) | Why It's a Leader |

|---|---|---|

| California | $48.2 Billion | Year-round growth + high demand for "Xeriscaping" upsells. |

| Florida | $31.5 Billion | 12-month mowing cycle; high density of gated communities. |

| Texas | $28.9 Billion | Massive residential expansion in the "Texas Triangle." |

| Colorado | $12.4 Billion | High business density per capita; affluent suburban markets. |

| New York | $11.1 Billion | High-ticket commercial maintenance and high-end residential. |

3. How Much Do Owners Make? (State-by-State Projections)

While employees (landscapers) average between $38,000 and $47,000, business owners with at least one crew see significantly higher returns. In states with high costs of living and specialized labor needs (like Alaska and Massachusetts), owners can command much higher service premiums.

Top 10 States for Lawn Care Owner Earnings (2026)

- Massachusetts: $150,517

- Washington: $148,200

- California: $146,800

- Alaska: $144,300

- New York: $141,100

- Colorado: $138,500

- Minnesota: $135,900

- New Jersey: $132,400

- Florida: $128,500

- Texas: $125,200

Note: In the "Transition Zone" (e.g., North Carolina, Tennessee), earnings are often more stable because the mix of cool-season and warm-season grasses requires more complex chemical treatment programs.

4. The 2026 Profitability Formula

To beat the state averages, successful businesses are pivoting their strategy in three specific ways:

A. The "Robot-as-a-Service" (RaaS) Model

With the release of fully autonomous commercial mowers (like the 2025 John Deere Electric Autonomous models), labor costs are being slashed. Instead of a three-man crew, owners are deploying "Robot Fleets" monitored by a single technician, moving labor costs from 35% of revenue down to 18%.

B. Route Density Over Distance

Profit is won or lost in the "windshield time." The most profitable owners in 2026 are using AI-driven routing software to ensure their crews never drive more than 8 minutes between stops. In high-density states like Delaware, this alone can increase daily billable hours by 25%.

C. The "Chemical" Upsell

Mowing is the "foot in the door," but the real money is in fertilization, weed control, and aeration. These services often boast 50–60% contribution margins, compared to the 15% seen in standard mowing.

5. Strategic Takeaways for Your Lawn Care Business

If you want your business to outperform the state averages listed above, focus on these key strategies:

- Embrace Recurring Revenue: Shift from one-off mowing to annual maintenance contracts. The most successful businesses in 2026 have 80%+ of their revenue from recurring contracts.

- Optimize Your Routes: Use modern routing software to minimize drive time between jobs. Every minute saved is money earned—and fuel costs reduced.

- Upsell High-Margin Services: Don't just mow. Offer fertilization, aeration, pest control, and seasonal cleanups. These services can double your profit margins.

- Invest in Technology: Whether it's autonomous mowers, GPS tracking, or customer management software, technology is the differentiator between six-figure and seven-figure businesses.

- Focus on Customer Retention: Acquiring a new customer costs 5x more than retaining an existing one. Implement automated reminders, loyalty programs, and exceptional service.

6. Challenges to Watch

- Labor Turnover: The industry still faces a 22% annual turnover rate. Competitive owners are offering "retention bonuses" tied to equipment care.

- Regulatory Pressure: States like California and New York have accelerated the phase-out of gas-powered small engines, forcing a capital-intensive shift to electric fleets.

- Weather Volatility: Extreme weather events are becoming more common, requiring flexible scheduling and backup capacity.

- Rising Fuel Costs: With crews traveling between jobs, fuel efficiency and route optimization are more critical than ever.

Conclusion

The lawn care industry in 2026 is no longer a "side hustle"—it is a sophisticated, tech-driven sector with massive upside for those who understand their local market data. Whether you are in a year-round state like Florida or a seasonal market like Massachusetts, the path to a six-figure owner income lies in efficiency, upsells, and route density.

Are you maximizing your lawn care business potential? Compare your numbers to these state averages and identify opportunities for growth.

Ready to scale your green industry business? Discover specialized tools and industry insights at Cadobook.

For more business management tools tailored to lawn care professionals, visit cadobook.com.

Related Resources

Features

- AI-Powered Quotes - Create accurate lawn care quotes quickly

- Invoicing & Payments - Subscription billing for recurring services

- Online Booking - Let customers schedule services online

- Automated Workflows - Automate route reminders and follow-ups

Related Articles

- Lawn Care Quoting Errors - Avoid common pricing mistakes

- How to Price Your Services - Pricing strategies for lawn care

- Small Business CRM Guide - Managing customer relationships

- Automated Payment Reminders - Improve collections

Industries

- Lawn Care Software - Complete lawn care business guide

- Landscaping Software - For full-service landscapers