If you're looking to start or scale an HVAC business in the United States, you aren't just entering a trade—you're entering a $130+ billion-dollar powerhouse. With extreme weather patterns becoming the new normal and a nationwide push for energy efficiency, the demand for HVAC services has never been higher.

But as any contractor will tell you, "making it" in HVAC looks very different in the humidity of Florida than it does in the frozen tundra of Alaska.

In this deep dive, we break down the revenue, profit margins, and owner earnings across the U.S. to see where the most money is being made in 2025 and 2026.

1. The Big Picture: U.S. HVAC Market Outlook (2025–2030)

The U.S. HVAC services market is projected to reach $29.89 billion by the end of 2026, with the total industry (including equipment sales) soaring past $150 billion.

Key Benchmarks for Success:

- Average Net Profit Margin: 8% to 12% (Top-tier companies reach 20%+).

- Average Revenue per Technician: $150,000 – $250,000 annually.

- Customer Lifetime Value (CLV): Approximately $15,340.

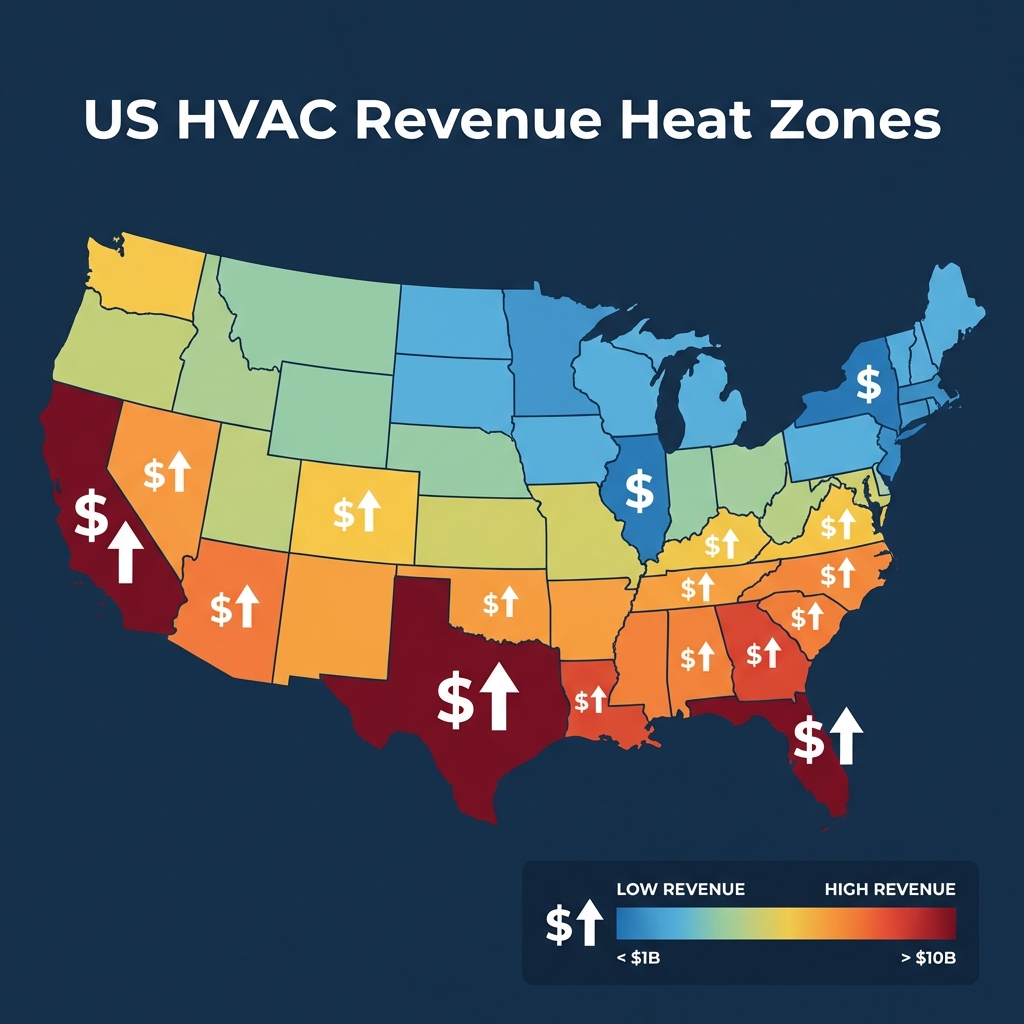

2. Revenue Giants: Top States by Market Volume

The "Big Three"—California, Texas, and Florida—continue to dominate the industry. These states represent the highest total revenue generated by contractors due to massive populations and non-negotiable climate needs.

| State | Estimated Annual HVAC Revenue (Contractor Total) | Key Growth Drivers |

|---|---|---|

| California | $33.71 Billion | Strict net-zero building codes & high tech adoption. |

| Texas | $22.26 Billion | Extreme heat waves & massive data center cooling needs. |

| Florida | $17.63 Billion | 100% AC dependency & rapid population growth. |

| New York | $12.40 Billion | High-density commercial retrofitting & aging infrastructure. |

3. How Much Do HVAC Business Owners Make? (State-by-State)

While total state revenue is high in places like Texas, the individual owner's take-home pay is often higher in states with a high cost of living or specialized labor shortages.

According to 2026 projections, the national average salary for an HVAC business owner is $86,197, though established owners often clear $150,000 to $200,000+.

Top 10 States for HVAC Owner Salaries (2026 Projections)

- Washington: $97,627

- New York: $94,303

- Massachusetts: $94,138

- Alaska: $92,830

- Vermont: $91,649

- North Dakota: $91,204

- Oregon: $91,135

- Colorado: $90,638

- Hawaii: $89,555

- Nevada: $87,775

Note: In the Southeast (e.g., Georgia, Arkansas), owner salaries average closer to $70,000 – $75,000, but this is often offset by a significantly lower cost of doing business.

4. The Profitability Equation: Why Some States Make More

It isn't just about how much you charge; it's about what you keep. Profitability in the HVAC world is currently driven by three major factors:

A. The "Heat Pump" Gold Rush

The Inflation Reduction Act (IRA) has changed the game. In states like Maine, Vermont, and Washington, the transition from oil/gas to electric heat pumps is creating a massive backlog of high-ticket installation work.

B. Refrigerant Phase-Outs

As the EPA phases out R-410A, repair costs for older systems are skyrocketing. Contractors in states with aging housing stocks (like Pennsylvania and Ohio) are seeing a surge in "emergency replacements" because repairs are no longer cost-effective for homeowners.

C. The Labor Gap

There is a current shortage of roughly 110,000 technicians nationwide. In states like Alaska and Illinois, where technician wages are among the highest (averaging $72k–$78k), business owners must maintain higher margins to cover payroll but can often charge a premium for "specialized" or "certified" labor.

5. Strategic Takeaways for Your HVAC Business

If you want your business to outperform the state averages listed above, focus on these three metrics:

- Focus on Service Agreements: Recurring revenue from maintenance contracts (which captured 39% of industry revenue in 2024) is the best way to stabilize cash flow during "shoulder seasons."

- Optimize Customer Acquisition Cost (CAC): The current benchmark is $300 per new customer. If you are spending more, your net profit will likely dip below the 8% industry average.

- Modernize Your Tech Stack: High-earning businesses in 2026 are using AI-driven scheduling and "HVAC-as-a-Service" models to unlock predictable annuity revenues.

Conclusion

Whether you're operating in the high-rent districts of New York or the booming suburbs of Texas, the HVAC industry remains one of the most resilient sectors in the U.S. economy. Success in 2026 isn't just about turning a wrench—it's about understanding the specific climate, regulatory, and economic data of your state.

Are you earning what you should be? Compare your numbers to these state averages and start planning your next growth phase.

For more business insights and tools to manage your trade, visit cadobook.com.

Related Resources

Features

- AI-Powered Quotes - Create accurate HVAC quotes quickly

- Invoicing & Payments - Improve cash flow with faster payments

- Customer Management (CRM) - Track service agreements and customer history

- Automated Workflows - Automate maintenance reminders

Related Articles

- HVAC Quote Mistakes - Avoid common pricing errors

- How to Price Your Services - Pricing strategies for HVAC

- How to Launch a Profitable Trades Business - Starting your HVAC business

- Automated Payment Reminders - Improve collections

Industries

- HVAC/Mechanical Contracting - Complete HVAC software guide

- Electrical Contracting - Related trade software

- Plumbing Software - For plumbing contractors